- #Lift my experian credit freeze for free#

- #Lift my experian credit freeze how to#

- #Lift my experian credit freeze free#

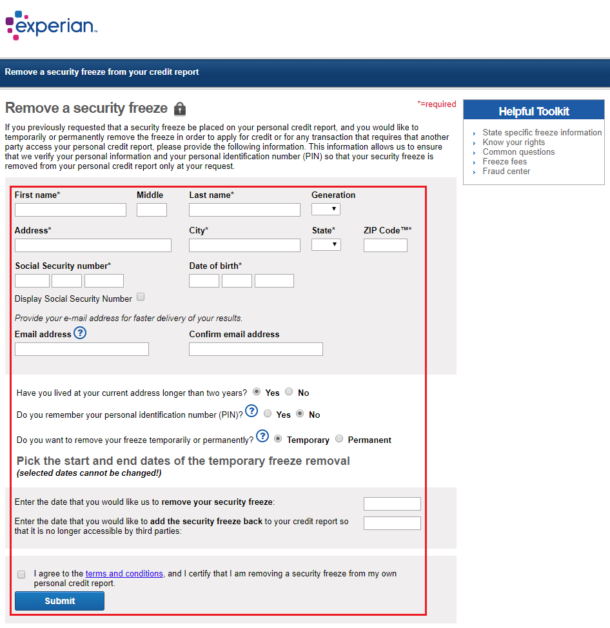

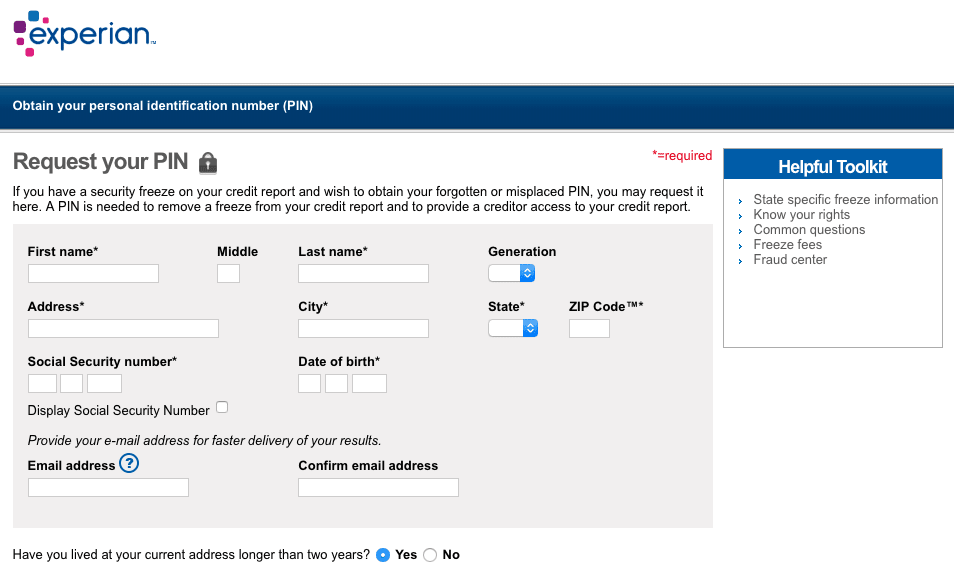

Learn more about NCTUE security freeze (for utilities) and how to place it.Learn more about ChexSystems security freeze (for banks) and how to place it.Please contact your Service Provider for details on their Norton plan offerings. §For Norton offerings provided to you by a Service Provider or through channels outside the United States, the LifeLock identity theft protection services and coverage, plan feature names and functionality might differ from the services offered directly by Norton. In a few states, it expires after seven years. In almost all states, a credit freeze lasts until you temporarily lift or permanently remove it. You will need them if you choose to lift the freeze with each bureau. Keep the PINs or passwords in a safe place. Copy of my bank statement (with account numbers blocked out)Īfter receiving your freeze request, each credit bureau will provide you with a unique PIN (personal identification number) or password.

#Lift my experian credit freeze free#

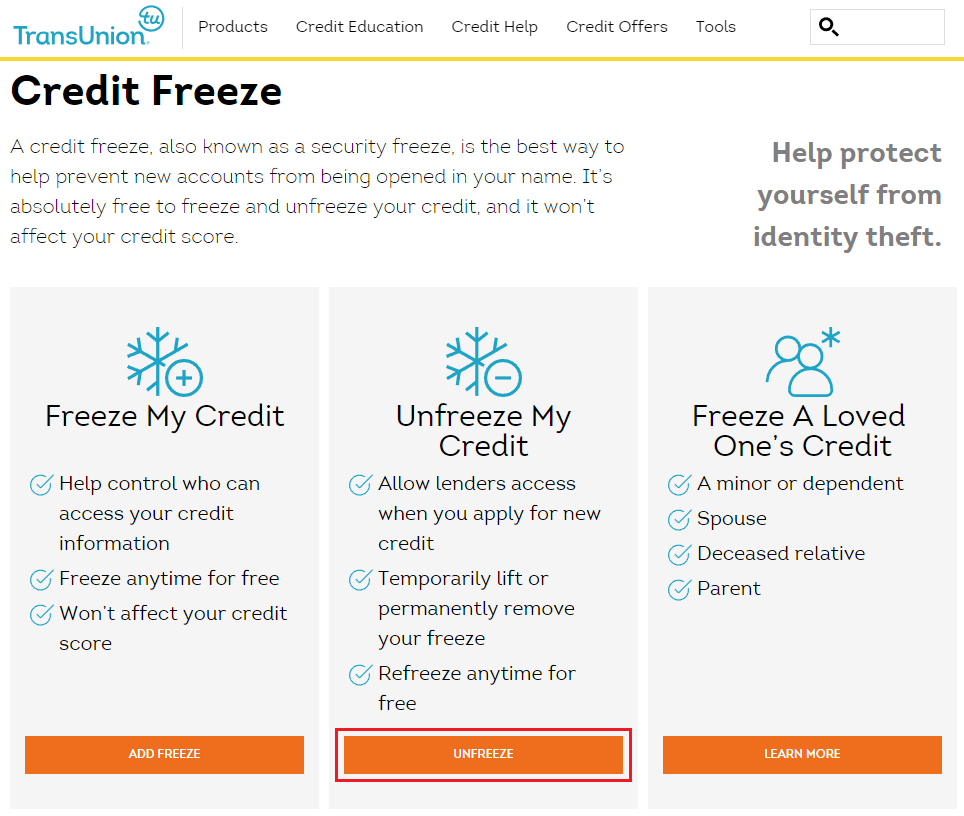

Remember, freezing your credit will not impact your credit score or prevent you from getting your free annual credit report and your existing creditors and certain governmental agencies will still have access to your credit report. While a credit freeze can help prevent identity thieves from opening accounts using your information, they will not prevent a thief from accessing existing accounts and will not prevent prescreened offers of credit.Īll the national bureaus are required, by law, to offer you credit freezes for free.

#Lift my experian credit freeze for free#

You can have the freeze lifted for free and place it again for free when you are done allowing access to your credit. If you need to do any of these, you can lift the freeze temporarily either for a specified time or to allow access to a specified party.

Keep in mind, however, that a credit freeze may prevent you from opening a new account, applying for a job, renting an apartment or buying insurance. If they can't review your report, they may not extent credit and then no account would be opened. Most creditors will want to request your credit report before they approve a new account. Learn more about credit freeze and how to place itĪlso known as a security freeze, a credit freeze allows you to restrict access to your credit report, which makes it more difficult for identity thieves to open new accounts in your name.

0 kommentar(er)

0 kommentar(er)